Blog detail

Retirement Savings - Pot - Contributions

By: Ilse de Klerk

New Pot - How would my contributions be implemented?

After receiving information from different sources, this is my understanding of the new rules.

As of September 2024, there will be NO more contributions allowed into the Vested Pot.

Your monthly contribution will be split.

1/3 will be allocated into the Savings pot.

2/3 will be allocated into the Retirement pot.

Example:

My total premium is R1 000 pm

My savings pot will receive R 333. 33

My retirement pot will receive R 666.67

I want to add a lump sum to my retirement savings.

My total lump sum is R50 000

My savings pot will receive R16 666.66

My retirement pot will receive R33 333.33

Impact of the new "POT" system

You do have once-a-year access to the savings pot, depending on the fund value, which wasn't an option before.

Actual contributions to the retirement portion are less. Less money to be utilized to grow your retirement fund.

Savings pot option

You do have the option to transfer funds from your savings pot into your retirement pot.

These transfers will not be taxed at your marginal tax rate. It is an 'internal transfer'.

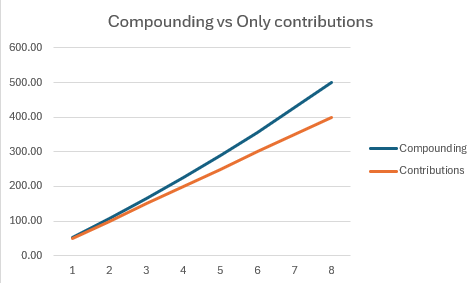

Please remember the 'golden key' to savings is compounding interest.

Build your retirement pot.